How Much Did Blue Linx Pay for Cedar Creek

In this article, I will present an interesting investment opportunity for a company I believe to be heavily undervalued. The operation is worth at least $19 before incorporating any synergies. Including all the synergies, the stock could be worth $65. Furthermore, the company owns land and warehouses worth $9-16 per share. Meanwhile, the stock is currently trading at only $26.

Source: YouTube

Negative industry sentiment and the high leverage of the company are the main reasons this opportunity exists. If you believe in management's ability to deliver the declared synergies and that the housing industry will recover, then BlueLinx Holdings Inc. (NYSE:BXC) would be an interesting investment opportunity.

The Company and its history

BlueLinx is a distributor of building products operating in the east side of the USA. Its sales are evenly split between structural and specialty products which are principally used for constructing new homes and repairing/ remodeling existing homes. Structural products are products such as lumber, plywood and rebar while the specialty products include deckings, engineered lumber and insulation products.

Source: Company Presentation

BXC is a two-step distributor. In other words, BXC is the intermediary between manufacturers such as DowDuPont (DWDP), West Fraser (WFTBF) and Roseburg and the one-step distributors and retailers such as BMC (BMCH), Thor Industries (THO) and Lowe's (LOW).

In May 2004, management with Cerberus Capital Management acquired the assets from Georgia-Pacific for $824MM ($776MM initially and $48MM later as a working capital adjustment).

In December of the same year, BXC offered 9.5MM shares via an IPO. Cerberus kept 61% of the shares (18.1MM), management 6% and the remaining 32% was offered to the market. The 29.5MM shares were reduced through a reverse split in 2016 and currently there are 9.3MM shares outstanding. In 2017, Cerberus conducted a secondary offering of its shares, obtaining proceeds of just $27MM. The stock is mostly owned by institutional investors. Nokomis Capital has the largest position at 12.9% of the equity of the company.

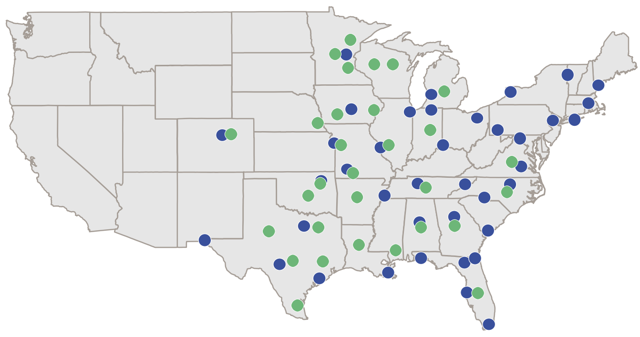

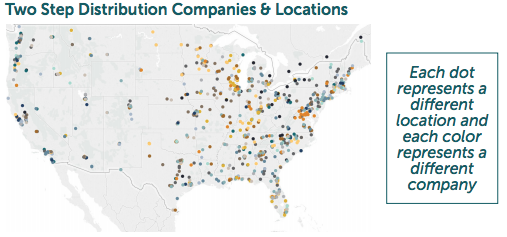

In 2018, BXC acquired Cedar Creek for $413MM which implies a EV/EBITDA multiple of 6.9x (pre-synergies). Cedar Creek was acquired by Charlesbank Capital Partners in 2010 and in the following 6 years grew the operation via nine acquisitions. In the map below, the warehouses for BXC and Cedar Creek are shown in blue and green, respectively.

Source: Company Presentation

Pre-acquisition of Cedar Creek, BXC stock was trading at $10. After the merger, the stock popped to $45 and by the end of 2018, the stock dropped to around $20 due to macro concerns such as the trade war with China and lumber prices but also for company-specific concerns such as its high leverage. As the macro concerns calmed down (for now), the stock partially recovered to $26.

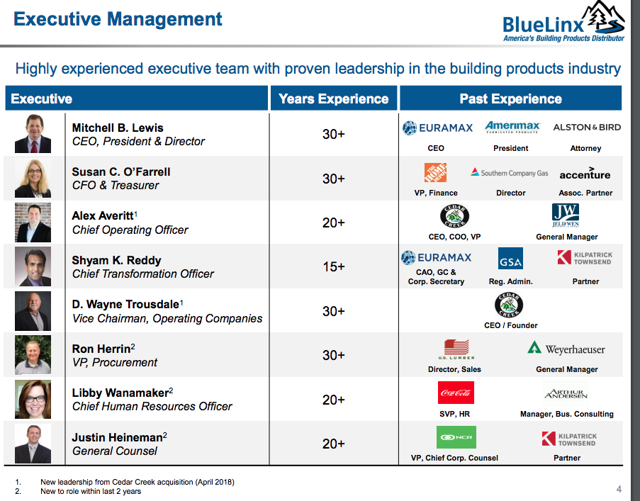

The merged company is managed by BXC management while the Cedar CEO became BXC COO and the founder of Cedar Creek stayed in the board as the Vice Chairman.

Source: Company Presentation

Industry

Single-Family Housing Starts

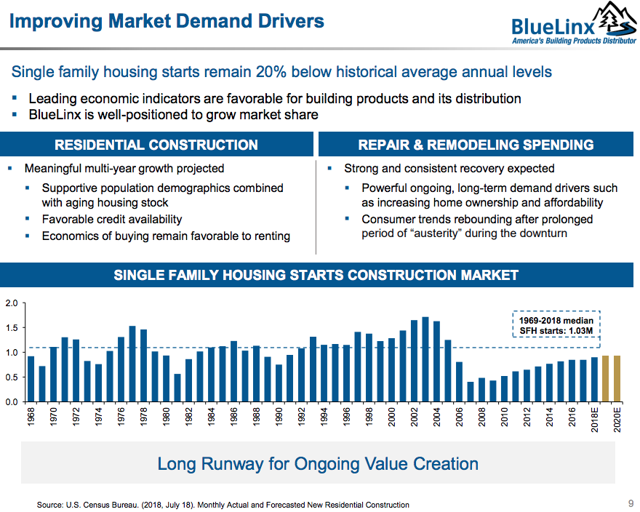

The main macro driver for the industry is the single-family housing starts. Company presentations and investor theses argue that housing starts are recovering after the 2008 drop but it is not yet close to the long-term average of 1.0-1.42MM.

Source: Company Presentation

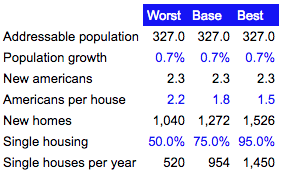

While I tend to agree with this, the data is contaminated with other factors such as industry subsidies, interest rates, vacancy rates, etc. A simplistic sustainable long-term housing starts model for the American economy suggests housing starts of just below one million. New houses are mostly occupied by new couples and singles leaving home. I assumed an average of 1.8 persons per new house (80% x 2 persons + 20% x 1 person) and that 3 quarters of new houses would be single-family houses.

Source: Author estimates

Two-Step Distribution

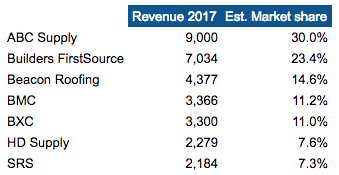

According to Principia Consulting, the two-step distribution industry in the United States is a $30-bn industry. Thus, BXC has 11% national market share in the fifth place.

Source: Author estimates based on data in mdm

However, I believe that BXC's market share is a bit higher on a regional basis as BMC lacks presence in the Midwest.

Soure: Principia Consulting

The valuation

BXC declared that it will divest some non-core assets, mainly real estate and warehouses. Below, I valued the core operation and the assets held for sale separately.

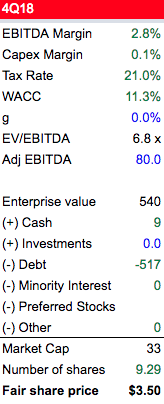

Core Operation

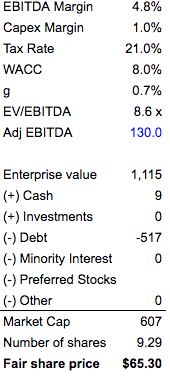

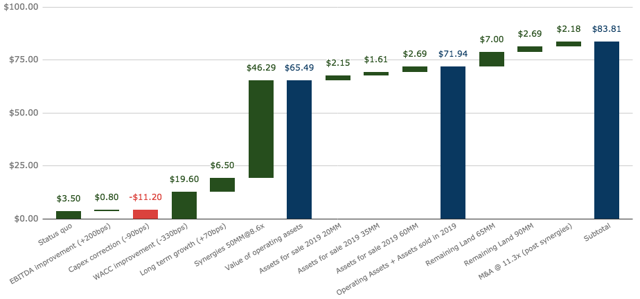

Assuming that the current EBITDA margin does not improve, no growth and a WACC of 11.3%, the "fair" EV/EBITDA Multiple is 6.8x, implying a $3.50 stock price. Please not that this ignores any non-core assets such as the assets held for sale.

Source: Author Estimates

However, the previous scenario may be too pessimistic. Modifying the economics to a more probable scenario, the fair multiple increases to 8.6x leading to a stock price of $19.20. The modifications are as follows:

-

The industry should grow at least with population growth. Assuming BXC keeps its market share, terminal growth rate of BXC should stay equivalent to the population growth of 0.7%.

-

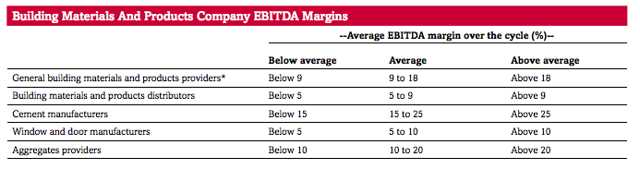

EBITDA margin should increase to a sustainable long-term margin just below 5%. If the $50MM in synergies is obtained, margins should improve by 1.5-1.7%. I think $50MM is a pretty conservative assumption. Management believes it can save $10MM in G&A, $17.5MM in route optimization/overlap markets and $22.5MM in cost disparity/supplier rationalization. I wouldn't be surprised if it left a cushion of at least $25MM. I think it left this cushion in supplier rationalization which is the largest part of BXC's COGS (2.6bn) and a bit in SG&A as well. Furthermore, the table below suggests that the average margin should be between 5% and 9%. I like to err on the conservative side so I used 5% and deducted 20bps, as margins should deteriorate a bit after the sale-lease back of BXC's warehouses.

Source: S&P Ratings

-

In the long term, capex should at least cover maintenance capex. I assumed the depreciation of 0.6% to be a good proxy for maintenance capex. Then I added 40bps as growth capex to sustain the 0.7% long-term growth rate.

-

BXC should de-lever due to divestment of its land/warehouses and thanks to its increased EBITDA (due to the synergies). As a result, the perceived risk of the company should decline. I expect WACC to decline to 8%.

Valuation Including the $50MM synergies

Source: Author estimates

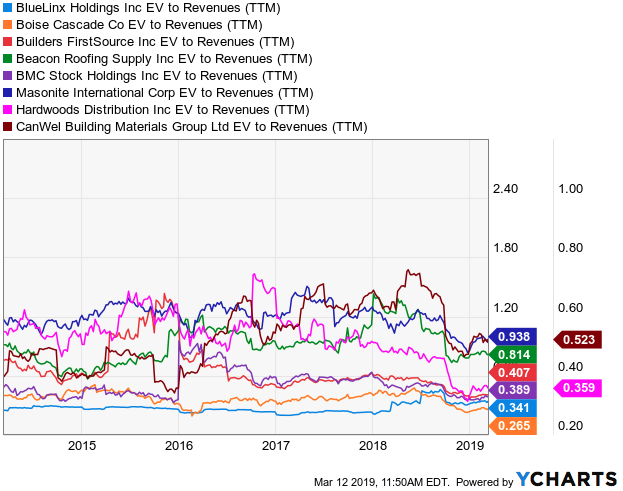

Even the 8.6x multiple seems conservative. In February 2018, Grafton acquired Leyland for 11.3x. Another indication of the significant discount in the stock is based on revenues as shown in the graph below. Also, three M&A transactions since 2017 were completed at multiples of 0.9x, 1.0x and 1.7x of revenues that support the same argument.

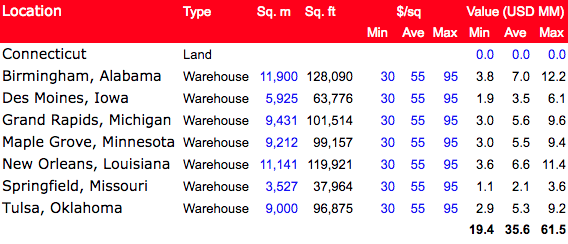

Assets for sale

As declared in the latest 10-k, BXC is planning to sell land in Connecticut, and six warehouses located in the Midwest and Southeast within the next 12 months. Using Google Maps, I found the warehouses and measured the approximate sizes of those warehouses. As for the land in Connecticut, I failed to find any details regarding the land properties, so I neglected the value of the land from the exercise. I expect the sale of the warehouses in 2019 to raise $20-60MM (pre-tax).

Source: Author estimates

The catalysts and risks

While an improvement in the macros of the industry such as lumber prices and housing starts should help the stock, the main catalysts would be regarding the synergies and assets sale.

The main risk involves the high leverage. If BXC fails in integrating the two operations and the synergies are not crystallised, the company may need to amend the debt or risk having to file for Chapter 11.

Conclusion

I expect the stock to be worth $65 after all the synergies are crystallised. Including the sale of the assets declared for 2019, the stock could be worth $72. The remaining assets could be worth another $65-90MM ($7.00-9.70/sh.). Finally, if BXC is acquired, we could expect the shares to be worth close to $84.

Source: Author estimates

Source: Author estimates

Having said that, I think that in the medium term the stock should be trading between $65 and $75 once we receive more news regarding the synergies. Once we obtain more data points regarding the divestment of the assets, we could refine the valuation closer to the upper end of our valuation. But for now, I am happy leaving my target price at $65.

This article was written by

"Price is what you pay, value is what you get"Here is my advice:1. Save 10% of whatever you make, no matter how insignificant it can be. As a young engineer, I saved 10% of my income no matter if it was $10 or $1,000. PAYING YOURSELF is the best piece of advice you can give anyone. I recommend the book 'The Richest Man in Babylon', it is a bit repetitive but entertaining and gets the point across.2. Invest in your competitive advantage. If you are an oil veteran, you should be investing in E&P companies and not in biotech start-ups. If you want to diversify, pay someone to give you advice on other sectors or buy ETFs with the right exposure. As for me, I graduated very young and worked in transportation and consumers as an engineer. Post-MBA I worked for one of the largest hedge funds covering sectors such as natural resources (including oil & gas), TMT, consumers, industrials and transportation. After that, I was a finance executive for Fortune 500 companies leaders in the consumers and TMT sectors. So you will never see me investing in financials, education or healthcare. I get exposure to those sectors via ETFs and professionals I trust.3. Don't trade but rather invest. Once I left the hedge fund world, I started an asset management firm for family, friends and HNWI. I was able to manage this fund while having extremely demanding roles by investing in the long term. When I buy a company, I just sell if my investment thesis is not valid anymore. Thus, I would just dedicate my Saturdays to reviewing my portfolio and exploring new opportunities. 4. Do what you love, not what makes the most money. You may leave money on the table in short term, but you will be happier in the long term even if you make less money overall.In my spare time, I like reading, rowing and enjoying life.

Disclosure: I am/we are long BXC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4250938-significant-value-hidden-in-bluelinxs-assets

0 Response to "How Much Did Blue Linx Pay for Cedar Creek"

Publicar un comentario